- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Relevant Introduction

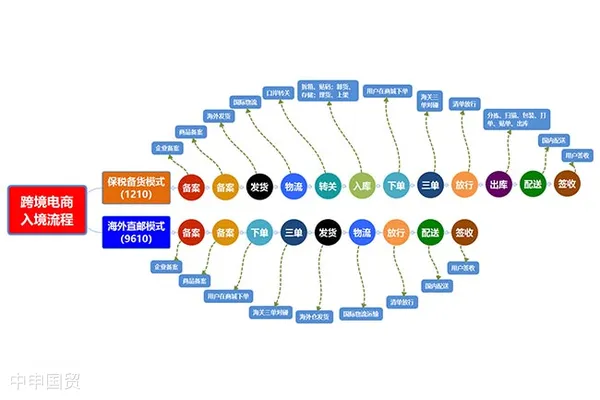

Cross-border E-commerceCross-border e-commerce involves multiple stages, such as procurement, logistics, customs clearance, and payment, and issues in any stage can affect the entire process. Sometimes cross-border e-commerce businesses require export agency services to reduce costs, improve efficiency, mitigate risks, or expand markets. Export agency service providers can offer one-stopforeign tradecomprehensive services, including market research, product selection, price negotiation, contract signing, cargo transportation, customs clearance, etc.

Here are some methods for selecting a qualified export agency service provider:

Choosing a good export agency service provider requires evaluating multiple factors, such as company strength, expertise, customs rating, service scope, and pricing. Companies can seek suitable providers through referrals, online searches, or on-site visits. Additional details to consider include whether the provider has sufficient funds to advance tax rebates, whether it operates purely as an agency or also engages in self-operated business, and whether it has high staff turnover.

Export agency service provider feesstandards

Export agency service providers typically charge fees based on the USD value of exported goods. Different agencies may have varying fee structures, such as charging service fees and profits as a percentage or collecting advance funding fees as a percentage of the tax rebate amount. Companies can select a suitable provider based on their export volume and tax rebate situation.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912